Dubai UAE

Sallam Sallam

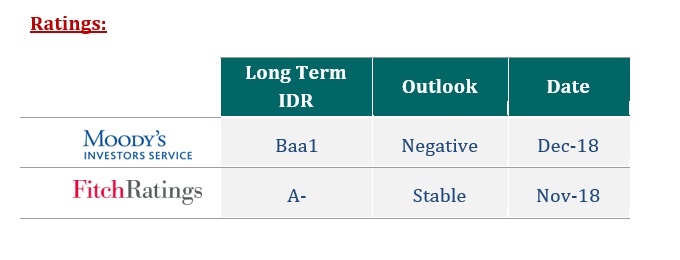

Commercial Bank of Dubai (CBD) today reported its financial results for the first quarter of 2019

Financial Highlights

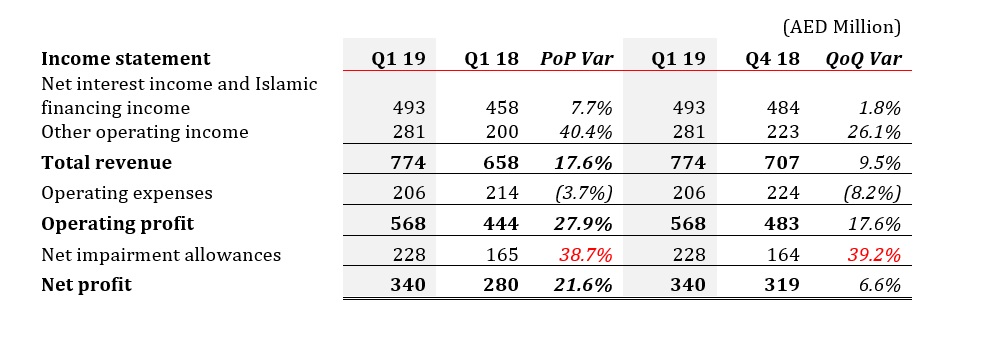

- Operating income of AED 774 million was up 17.6% year on year driven by higher net interest income and other operating income

- Expense discipline delivered a 3.7% decrease in expenses to AED 206 million

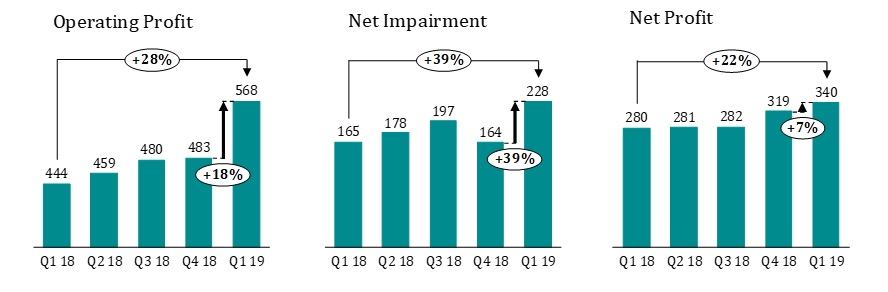

- Operating profit of AED 568 million before impairment allowances was up 27.9%

- Net impairment allowances were AED 228 million, higher by 38.7% when compared to the first quarter of 2018

- Net profit of AED 340 million represented a 21.6% increase over the same period last year

As at 31st March 2019:

- Capital ratios strengthened with the capital adequacy ratio (CAR) improving to 15%

- Gross loans were AED 55 billion, an increase of 9.2% over the prior comparative period

- Advances to stable resources ratio (ASRR) stood at 87.8%

- Non-performing Loan (NPL) ratio improved from 8.7% to 6.0%

- Coverage ratio for non-performing loans improved from 66.0% to 81.6%

Performance Review

| Solid sustainable high quality result with sound business momentum

|

The Commercial Bank of Dubai delivered a strong quarterly result with net profit up 21.6% to AED 340 million on the back of a 17.6% increase in operating income, a 3.7% decline in operating expenses; impairment allowances meanwhile increased by 38.7% as the bank conservatively provided for non-performing loans.

Operating income for Q1 2019 amounted to AED 774 million, an increase of 17.6% attributable to a 7.7% increase in net interest income (NII) and a 40.4% increase in other operating income (OOI).

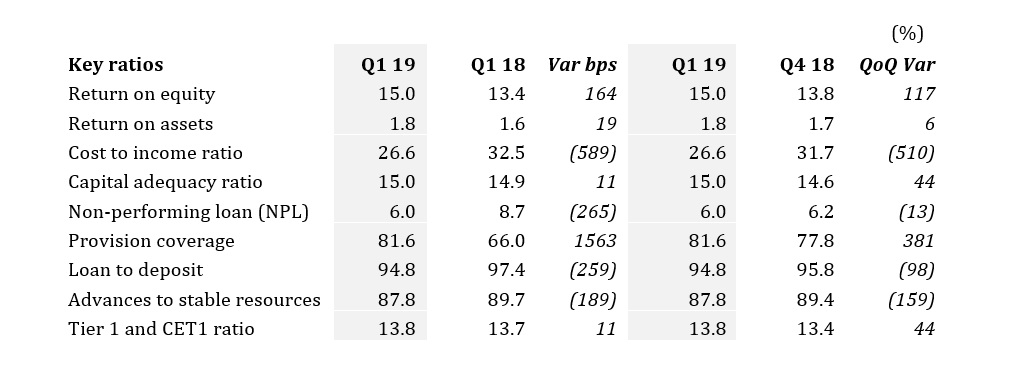

Operating expenses were AED 206 million, down 3.7% on the back of disciplined expense management through improved efficiency and the result of digital transformation. The cost to income ratio improved to 26.6% for the quarter (Q1 2018: 32.5%).

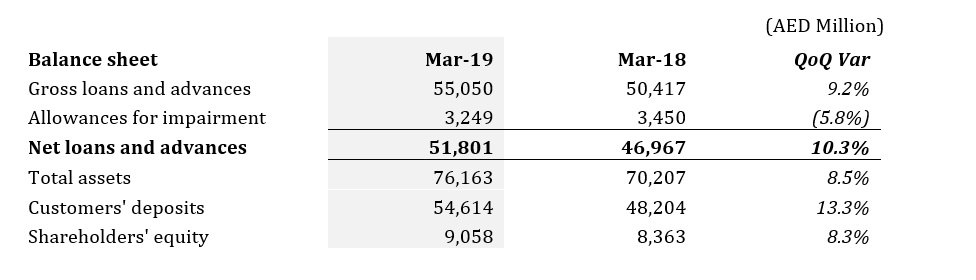

Balance Sheet

Total assets were AED 76.2 billion as at 31st March 2019, an increase of 8.5% compared to the AED 70.2 billion as at 31st March 2018.

Loans and Advances were AED 51.8 billion, registering an increase of 10.3% when compared to AED 46.9 billion as at the end of first quarter 2018.

Customers’ Deposits were AED 54.6 billion as at 31st March 2019 representing an increase of 13.3% compared to AED 48.2 billion at the end of first quarter 2018. Low cost current and savings accounts (CASA) constitute 42.9% of the total deposit base, while the financing-to-deposits ratio stood at 94.8%.

Asset Quality:

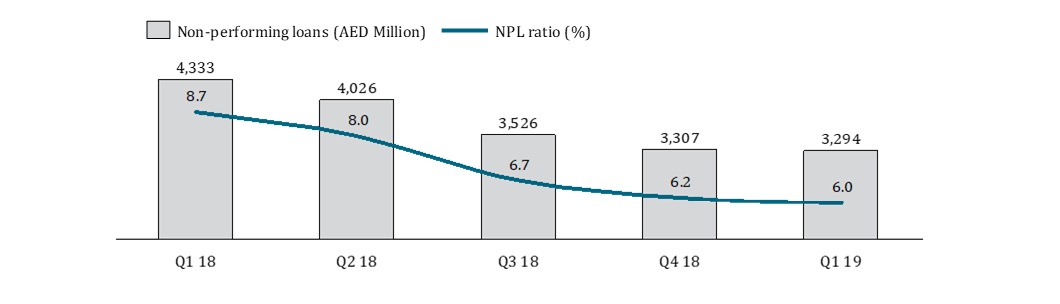

The non-performing loans (NPL) ratio decreased significantly to 6.0% from 8.7% at the end of first quarter 2018, with both ratios calculated under IFRS9.

In line with the bank’s prudent provisioning policy, additional net impairment provisions of AED 228 million were set aside during the first quarter compared to AED 165 million for the same period in the prior year. As at the end of March 2019, total allowances for impairment amounted to AED 3,249 million.

Liquidity and Capital position

The bank’s liquidity position remained robust with the advance to stable resources ratio at 87.8% as at 31st March 2019 (Q1 2018: 89.7%) compared to the UAE Central Bank 100% limit.

CBD’s Capital Ratios strengthened with capital adequacy and Tier 1 capital ratios at 15.0% and 13.85%, respectively, and were significantly above the regulatory thresholds mandated by the UAE Central Bank.

Commenting on the bank’s performance, Dr. Bernd van Linder, Chief Executive Officer said, “CBD posted a strong set of results for the first quarter of 2019 as net profit increased by 21.6% underpinned by higher income and lower cost. The balance sheet remains solid with a further improvement in capital and liquidity coupled with a significant improvement in non-performing loans, coverage and the cost to income ratio. We will continue to focus on supporting customers and creating long term value for our shareholders”.