DAE provides 1H2020 Business Update

Available liquidity of $2.8 billion; rent deferral assistance to 30% of customers

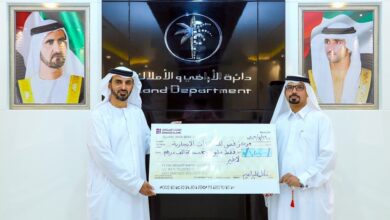

Dubai, U.A.E.

Sallam Sallam

Dubai Aerospace Enterprise (DAE) Ltd. released today the following updates on business activity, liquidity and customer deferral requests:

Business Activity: DAE’s owned, managed and mandated-to-manage fleet stayed stable at 400+ aircraft. During 1H2020, DAE sold or novated 17 aircraft, acquired 5 aircraft, transitioned or extended leases on 23 aircraft, and negotiated 41 lease extensions subject to documentation. Since the onset of the pandemic, we have transitioned 11 aircraft with 18 ferry flights to and from 9 countries. Portfolio lease utilization remained high and is above 99%. The managed aircraft portfolio grew to 73 aircraft.

Liquidity: DAE ended 1H2020 with total available liquidity of US$2.8 billion which comprised of approximately US$600 million of unrestricted cash and US$2.2 billion of long-term committed available lines of credit. We repurchased US$187 million of our own bonds in 1H2020. Over the next 12 months, we have only one bond maturity of US$430 million in August 2020.

Customers: DAE continues to receive rent deferral requests. To date, we have granted 29 rent deferral requests totaling aggregate rent of approximately 12% of annual reported revenue. We are currently evaluating an additional 28 rent deferral requests totaling aggregate rent of approximately 6% of annual reported revenue. We expect to provide additional assistance to our clients and we also expect arrears to climb as our clients continue to refine their operating models.

Firoz Tarapore, DAE’s Chief Executive Officer said: “The first half of 2020 has proven to be the most challenging half year ever for the global aviation industry. As we continue to navigate through uncertain times, DAE has focused on executing well on the fundamentals. During the last 6 months, we have transitioned aircraft to new airline customers, we have actively taken back aircraft from airlines that did not need capacity and placed them with other existing clients, and we have grown our managed asset portfolio.

“We have used our industry-leading liquidity position to assist clients with rent deferrals, support our bond repurchase program and still maintain a strong liquidity profile. We do not have any speculative orders with an OEM and we do not expect that to change in the near-term.

“Our team of professionals continues to leverage our technology investments and deliver our platform capabilities to our clients in a seamless way every day.”