Dubai UAE

Sallam Sallam

Commercial Bank of Dubai (CBD) today reported its financial results for the first quarter of 2020.

Noteworthy Financial Commentary:

2020 first quarter results:

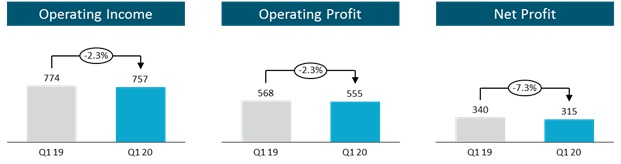

► Net profit was AED 315 million, 7.3% below the prior comparative quarter

► Operating income was AED 757 million down, by 2.3% compared to the prior comparative quarter predominantly due to lower interest rates

► Operating expenses were lower by 2.2% to AED 201 million

► Operating profit was AED 555 million, down by 2.3%

► Net impairment allowances were AED 240 million due to higher forecast credit losses expected on the back of the Covid-19 pandemic as well as specific credit provisions

As at 31st March 2020:

► Capital ratios remained strong with the capital adequacy ratio (CAR) at 13.86% and the common equity Tier 1 ratio (CET1) at 12.71%

► Gross loans were AED 65.8 billion, an increase of 2.8% compared to 31st December 2019

► Advances to stable resources ratio (ASRR) stood at 90.8%

► Non-performing loan (NPL) ratio increased by 66 bps to 6.59% compared to 5.94% in 2019

Performance Review

The Commercial Bank of Dubai has delivered a net profit result of AED 315 million for Q1 2020

down 7.3% against Q1 2019. The result was adversely impacted by low interest rates, weaker business conditions, specific credit events and anticipated impacts associated with the Covid-19 pandemic. Consequently, impairment allowances taken were AED 240 million for Q1 2020.

Operating income for Q1 2020 amounted to AED 757 million, a decrease of 2.3% attributable to lower Net Interest Income (NII) (1.7%) as a result of sharply lower interest rates and a 3.3% decrease in Other Operating Income (OOI).

Operating expenses were AED 201 million, down 2.2% compared to Q1 2019. The bank continued investment in digital capability to support customers whilst maintaining strong expense discipline across business operations. The cost to income ratio decreased to 26.6% from 29.4% in Q4 2019.

|

(AED Million) |

|||||||

|

Income statement |

Q1 20 | Q1 19 | PoP Var | Q1 20 | Q4 19 |

QoQ Var |

|

|

Net interest income and Islamic financing income |

485 |

493 | (1.7)% | 485 | 461 |

5.1% |

|

|

Other operating income |

272 | 281 | (3.3)% | 272 | 330 |

(17.6)% |

|

|

Total revenue |

757 | 774 | (2.3)% | 757 | 791 | (4.4)% |

|

|

Operating expenses |

201 | 206 | (2.2)% | 201 | 232 |

(13.4)% |

|

|

Operating profit |

555 | 568 | (2.3)% | 555 | 559 |

(0.6)% |

|

|

Net impairment allowances |

240 | 228 | 5.1% | 240 | 222 |

8.3% |

|

| Net profit |

315 |

340 |

(7.3)% |

315 |

337 |

(6.4)% |

|

Balance Sheet

Total assets were AED 89.9 billion as at the 31st of March 2020, an increase of 2.1% compared to AED 88.1 billion as at the 31st of December 2019.

Net loans and advances were AED 62.3 billion, registering an increase of 3.6% compared to AED 60.2 billion as at the end of 2019.

Customers’ deposits were AED 63.9 billion as at the 31st of March 2020 representing an increase of 0.9% compared to AED 63.3 billion at the end of 2019. Low cost current and savings accounts (CASA) constitute 40.6% of the total deposit base, while the financing-to-deposits ratio stood at 97.6%.

|

(AED Million) |

||||

|

Balance sheet |

Mar-20 | Dec-19 | YTD Var |

|

|

Gross loans and advances |

65,848 | 64,039 |

2.8% |

|

|

Allowances for impairment |

3,513 | 3,858 |

(9.0)% |

|

|

Net loans and advances |

62,335 | 60,181 |

3.6% |

|

|

Total assets |

89,881 | 88,069 | 2.1% | |

| Customers’ deposits | 63,900 | 63,334 | 0.9% |

|

|

Shareholders’ equity |

9,695 | 10,217 |

(5.1)% |

|

Asset Quality

The non-performing loan (NPL) ratio increased to 6.59% up from 5.94% at the end of 2019.

In accordance with IFRS9 accounting standards, the bank increased expected credit losses, predominantly associated with forecast Covid-19 impacts and several specific credit events. As a result, the net impairment provisions totalled AED 240 million for the quarter. The coverage ratio was 66.62%, down from 83.14% at the end of 2019. As at the 31st of March 2020, total allowances for impairments amounted to AED 3,513 million.

Liquidity and Capital position

The bank’s liquidity position remained robust with the advances to stable resources ratio at 90.8% as at the 31st of March 2020 (2019: 88.0%) compared to the UAE Central Bank limit of 100%.

CBD’s capital ratios remained strong with the capital adequacy and common equity Tier 1 (CET1) ratios at 13.86% and 12.71%, respectively. All capital ratios were significantly above the minimum regulatory thresholds mandated by the UAE Central Bank.

|

(%) |

||||||||||||

|

Key ratios |

Q1 20 | Q1 19 | PoP Var | Q1 20 | Q4 19 |

QoQ Var |

||||||

|

Return on equity |

13.14 | 15.02 | (188) | 13.14 | 13.39 |

(25) |

||||||

|

Return on assets |

1.55 | 1.79 | (24) | 1.55 | 1.58 |

(3) |

||||||

|

Cost to income ratio |

26.61 | 26.58 | 3 | 26.61 | 29.38 |

(277) |

||||||

|

Capital adequacy ratio |

13.86 | 15.00 | (114) | 13.86 | 14.17 |

(31) |

||||||

|

Non-performing loans (NPL) |

6.59 | 6.04 | 55 | 6.59 | 5.94 |

66 |

||||||

| Provision coverage | 66.62 | 81.63 | (1,501) | 66.62 | 83.14 |

(1,652) |

||||||

|

Loan to deposit ratio |

97.55 | 94.85 | 270 | 97.55 | 95.02 |

253 |

||||||

|

Advances to stable resources |

90.80 | 87.83 | 297 | 90.80 | 87.96 |

284 |

||||||

|

Tier 1 and CET1 ratio |

12.71 | 13.85 | (114) | 12.71 | 13.02 |

(31) |

||||||

Commenting on the bank’s performance, Dr. Bernd van Linder, Chief Executive Officer said, “The current environment is challenging for every community around the world including across the United Arab Emirates. Notwithstanding this difficult operating environment we continued to grow our market share in Q1 20, delivering on our strategy.

First and foremost, we would like to commend our leaders and the government here in the United Arab Emirates for the outstanding proactive measures taken during this crisis period. These steps will ensure the well-being of our citizens and deliver a swift and complete recovery of the local economy. We would also like to highlight the comprehensive economic support measures undertaken by the Central Bank through the Targeted Economic Support Scheme (TESS).

Importantly, at CBD we have implemented a wide reaching program ensuring the safety of our employees and customers. At present, we have the vast majority of employees working remotely by successfully leveraging the digital investments made in systems and processes for our customers and employees over the last several years. We are also pleased to have been able to support our customers with tailored solutions aligned with TESS and to meet their banking needs through this difficult time.

Overall our underlying results were weaker by 7.3% on the back of lower interest rates, weaker business conditions and higher expected credit losses. In accordance with accounting standards, we have prudently increased forecast expected credit losses associated with Covid-19 in anticipation of challenging economic conditions for the remainder of the year. Notably, the bank’s capital base continues to provide a strong foundation for continued support to our customers during the ongoing economic uncertainty associated with Covid-19 and beyond. Liquidity and eligible liquid asset ratios are comfortably above the minimum levels prescribed by the UAE Central Bank”.

He added, “During this challenging period our organization will continue to support our customers now and into the future, and we will stand with UAE businesses as the economy moves into recovery”.

Ratings

|

Agency |

Rating | Outlook |

Date |

|

Fitch Ratings |

A- | Stable |

Jun-19 |

|

Moody’s |

Baa1 | Negative |

Dec-18 |