Dubai Economy organises the ‘Future Economy Lab’ to discuss post COVID-19 opportunities in Cashless Economy

Session brings focus on how Dubai can become an advanced cashless economy by transforming the digital payments landscape

Localised payment gateways, fintech start-up incubators, and improved cybersecurity solutions to build trust among initiatives discussed

Dubai,UAE

Sallam Sallam

Dubai Economy brought together major stakeholders in the cashless economy ecosystem at its latest Future Economy Lab hack (workshop) as part of its efforts to address the COVID-19 challenge and design the best approaches to optimising the opportunities presented by the new normal in the post-pandemic phase.

Globally, COVID-19 has been a key accelerator of digital connectivity and digital commerce, spurring faster adoption of cashless payments, and transforming digital payment channels and services. The main focus of the Future Economy Lab session was on accelerating growth of the cashless economy and improving financial inclusion to promote digital payments in the UAE. Attendees in the session were challenged to think “How might Dubai seize the opportunity to become the top 10 cashless economies in the next 3 years?”

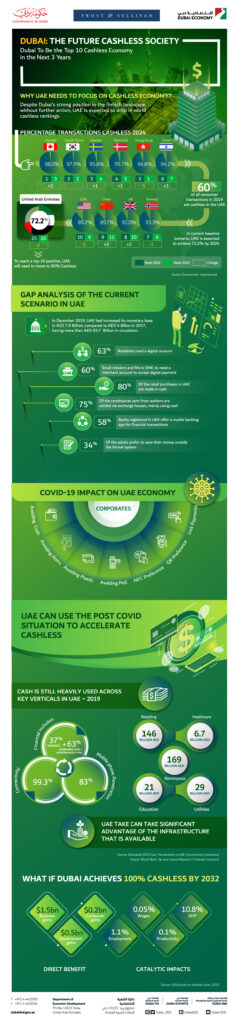

According to Euromonitor International, 60% of all consumer payment transactions in the UAE were non-cash payments in 2019, and the country stood 20th globally in cashless payments. Non-cash payments in the UAE is set to reach 73% by 2025, as estimated by current baseline scenario.

Dubai can benefit from catalytic impacts and economic growth between now and 2032 as well as time saved by consumers and businesses making greater use of digital payments, shows a Visa study on cashless cities[1]. The study predicts a US$2.2 billion (over AED 8 billion) worth of direct annual net benefits for consumers, businesses and governments from going cashless. The estimated gains for consumers will be $0.2 billion, while businesses will gain $1.5 billion and government will have $0.5 billion when a city moves to an “achievable level of cashlessness” – defined as the entire population of a city moving to digital payment usage equivalent to the top 10% of its users today.

The 2018 Visa study also shows a 1.1% improvement in current employment, wage growth rate of 0.05%, and a GDP growth of 10.8 points as some of the estimated long-term gains (by 2032).

Speakers at the session pointed out that the global acceleration in digital payments calls for the UAE to capitalise on its digital readiness to further boost its digital payments landscape. According to Euromonitor International’s Digital Connectivity Index, the UAE is ranked number 1 globally. This puts the country in a strong position to become one of the leading cashless societies in the world, joining the ranks of Denmark, Sweden and South Korea. The high level of mobile connectivity in the UAE is also a significant advantage as the mobile is best positioned as an online and offline payment channel and an enabler of financial inclusion.

Mohammed Shael Al Saadi, CEO Corporate Strategic Affairs in Dubai Economy commented: “Digital payments have assumed greater significance during this pandemic phase. Industries and societies adopting cashless payment faster has renewed the urgency for government to work with all stakeholders to implement an inclusive and effective digital payments system that will drive new economic value. Our hack was aimed to co-create new initiatives to meet the UAE’s vision of being one among the top 10 cashless payment economies”

The hack, facilitated with Frost & Sullivan, attracted 60 attendees including experts from banks, fintech companies, payment network/scheme providers, payment acquirers, other financial institutions, government entities, and academia. The key objectives of the session were to define the challenges and opportunities within the financial ecosystem that Dubai can develop to yield maximum impact; identify how key industry stakeholders can utilize the momentum in the cashless economy and expand their digital payment solution offerings; and to collaborate to develop and prioritise initiatives that can support Dubai’s shift towards a cashless society.

Osama Al Rahma, CEO Al Fardan Exchange and Director – Al Fardan Group, commented: “Dubai Economy is playing a strategic role as one of the fundamental drivers towards the cashless economy. As a member of the remittance businesses community, I see and observe dreams and visions coming true. I see this initiative as integral to embracing changing business models in line with the shifts toward digital transformation in the payment industry. This addresses the new customer behaviour and their changing requirements.”

Some of the challenges to adoption highlighted include limited access to digital products and services, lack of digital Infrastructure and fintech ecosystem required to grow the cashless economy, the cultural and habitual attachment to cash, and payment maturity vs innovation readiness to drive future of payments.

The initiatives discussed during the hack included creating incubators for fintech start-ups, development of localised payment gateways, providing financial education to the unbanked and underbanked, and increasing trust in cashless payments through cybersecurity solutions.

Etisalat Spokesperson-Dr Tamer Eltoni, Vice President, Digital Services & Devices, Etisalat and Chief Commercial Officer, Digital Financial Service commented, “Thanks to the UAE leadership’s vision, the country has the highest adoption of digital technologies and penetration in the region and globally. Etisalat’s strategy and vision ‘Driving the digital future to empower societies’ aligned with the government’s digital goals has led to one of the most advanced infrastructures globally. This was a great opportunity to be part of the cashless economy workshop of Dubai Economy, which brought together industry leaders to discuss how to make UAE one of the top digital payment countries before 2023. Such a platform brought to light interoperability and the need for new business models to achieve financial inclusion in a cashless environment.”

Vibhor Mundhada, Senior Vice President, Business Manager- Merchant Acquiring at Mashreq, said it was a privilege to be a part of the workshop and added: “ The event was well organised with representation from all key stakeholders including banks, telco providers, payment companies as well as new age tech companies and consultants. The break-out discussions were relevant and thought provoking which brought out various ideas and themes. The pandemic has accelerated the shift towards digital payments and we, at Mashreq, are fully committed to be partners with Dubai Economy in shaping a cashless future for the UAE.”

Dubai Economy established the Future Economy lab as a strategic initiative to engage with private sector entities, regulators and academia, and explore future economic opportunities. The workshops are now part of a ‘CovExit’ (COVID Exit) initiative aimed to map the post-pandemic recovery and identify new opportunities to shape the future of existing and emerging sectors by 2030. The upcoming hacks in the series covers topics such as the Future of Healthcare, Real Estate, Agritech and Food Services, Manufacturing and Edutech.

For further details on the Future Economy Labs, please write to fed@dubaided.gov.ae or call +971 4 445 5745.