flydubai sees return to profitability

Boeing 737 MAX aircraft grounding severely impacts growth strategy

flydubai has today, 04 March 2020, announced its Annual Results for the reporting period ending 31 December 2019

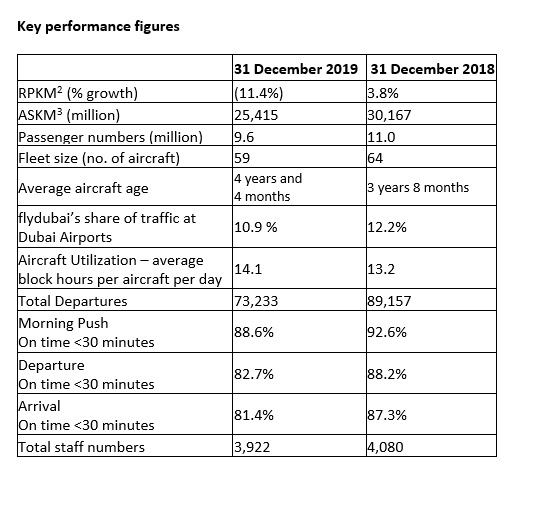

flydubai reports total annual revenue of AED 6.0 billion (USD 1.6 billion) compared to AED 6.2 billion (USD 1.7 billion) last year; a decrease of 2.6% compared to the same period the previous year

Reports a profit of AED 198.2 million (USD 53.9 million)

flydubai concludes an interim settlement agreement with Boeing

Carries 9.6 million passengers

Dubai UAE

Sallam Sallam

Ghaith Al Ghaith, Chief Executive Officer at flydubai, commenting on flydubai’s 2019 Annual Results, said: “We have had to manage a number of unprecedented issues faced by the aviation industry. Our Results demonstrate that we have capitalised on the strong fundamentals in our business, but it is regrettable that our growth strategy has been significantly impacted by the grounding of the Boeing 737 MAX.”

“Whilst 2019 has seen a return to profitability it does not reflect the loss of market position and the unfilled opportunities flydubai could have exploited.”

Ghaith Al Ghaith, Chief Executive Officer at flydubai, commenting on reaching an interim settlement agreement, said: “We have concluded an interim settlement agreement with Boeing for certain compensation due to flydubai in relation to the grounding of the Boeing 737 MAX. The details of the interim settlement agreement remain confidential. This agreement has contributed towards this year’s results, but in no way can it compensate for the loss of business opportunity or market share experienced by the airline. Discussions are continuing between the parties regarding the ongoing impact of the grounding.”

Francois Oberholzer, Chief Financial Officer at flydubai, said: “We have had to be even more flexible with the abrupt interruption of our growth and fleet strategy. We have kept a firm grip on the business against the continued uncertainty created by the grounding. Direct operating costs reduced by 17.8%, whilst we saw double digit growth in our yields minimising the reduction in revenue to 2.6% compared to a fall in capacity of 15.8%. Furthermore, we successfully refinanced our debut 2014 Sukuk during this financial year.”

Cost and revenue performance

EBITDAR[1]was reported at 29.5% of annual revenue compared to 21.1% in 2018.

Closing cash and cash equivalents position, including pre-delivery payments for future aircraft deliveries, is AED 2.6 billion compared to AED 2.1 billion last year.

Fuel costs were 25.8 % of total annual operating costs mainly due to a drop in the average price of jet fuel by 9%. The efficiency gains expected from the Boeing 737 MAX have not been realised with the continued grounding.

Ancillary revenue comprising baggage, cargo and inflight sales contributed 8.9% of revenue compared to 9.4% last year.

Financing: a USD 500 million 5-year Term Financing Facility was completed on 14 November. The Facility was used to refinance the carrier’s first landmark Sukuk which was issued in 2014 and matured on 26 November.

Operational performance

Network and new route launches: flydubai started direct flights to Krabi in Thailand on 12 December. The daily flights are operated via a short stop in Yangon, Myanmar and are codeshared with Emirates.

MAX aircraft: 11 Boeing 737 MAX 8 and 3 Boeing 737 MAX 9 aircraft remain grounded. These aircraft will not rejoin the operating schedule until regulatory approval has been received from the General Civil Aviation Authority (GCAA) and the regulatory authorities in the jurisdictions where the airline flies.

Flight cancellations: flydubai continues to ensure that it has optimised its schedule however 19% of its flying schedule has been cancelled as a result of the grounding.

Aircraft leasing: To be able to offer additional capacity during the busy seasonal travel period flydubai arranged Aircraft, Crew, Maintenance & Insurance (ACMI) agreements and three aircraft operated within the fleet between 14 December 2019 and 06 January 2020. Four aircraft operated between 07 January and 25 January 2020 and two aircraft are operating between 26 January and 31 March 2020.

Fleet size: at year end 45 aircraft were operating on the flydubai network which included its 42 Next-Generation Boeing 737-800 aircraft in addition to three aircraft leased from Smartwings.

Update on FZ 981: The Final Report was published by the Interstate Aviation Committee on 26 November. A team are working on the implementation of the eight recommendations.

Headquarters: construction of flydubai’s new head office is underway and is due to be completed in 2020.

Outlook statement for 2020

“The preparation for this year’s outlook statement is challenging given the uncertainty around the timetable for the return to service of the Boeing 737 MAX aircraft and the subsequent aircraft delivery schedule. With a current fleet size of 42 aircraft our ability to launch new routes and add frequencies will continue to be severely impeded. In order to further minimise disruption to our passengers’ travel plans we are currently exploring options to extend the term for the lease of aircraft that were due to leave our fleet in 2021.”

[1] Earnings Before Interest, Taxes, Depreciation, Amortisation and Rent

[2] RPKM Revenue passenger kilometre

[3] ASKM Available seat kilometre