Balance sheet up by 25% YoY to AED 289.6 billion

Financing & Sukuk investments up by 26% YoY to AED 232.0 billion

Operating revenue up by 2% YoY to AED 9.5 billion

Deposits up by 25% to AED 205.9 billion

Liquidity remains healthy with financing to deposit ratio of 96%

Net Profit of AED 3.2 billion

Noor Bank integration completed well ahead of schedule

Dividend of 20% subject to shareholder approval

Dubai Islamic Bank (DFM: DIB), the largest Islamic bank in the UAE and the second largest Islamic bank in the world, today announced its results for the period ending December 31, 2020.

FY 2020 results highlights:

Prudent approach to risk management to ensure long term sustainable growth

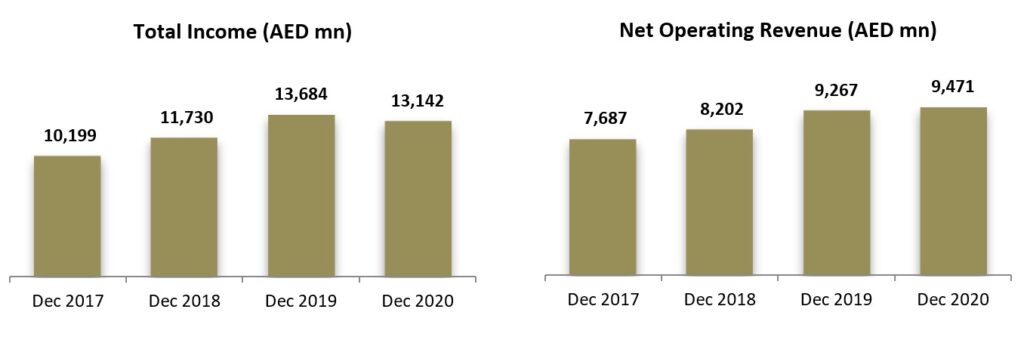

- Total Income reached AED 13,142 million vs AED 13,684 million in 2019, only a marginal decline despite significantly subdued economic activity, clearly highlighting the depth and diversity of the bank’s business and the strength of the relationships with its customer base.

- Operating revenue grew to AED 9,471 million up by 2%, depicting the strength of the bank’s core franchise which continues to grow despite the macro-economic landscape signifying the ability to generate higher profitability as the environment improves.

- Group Net Profit declined by 38% to AED 3,160 million primarily driven by a deliberate and pointed prudent approach to provisioning ensuring that the bank is protected against any unforeseen scenarios and positioned for a strong rebound in the near future.

- NPF ratio at 5.7%, whilst in line with the market given the current conditions, drops to 4.3% excluding the credit impaired portfolio acquired from Noor Bank and a one-off isolated corporate exposure.

Strategic shift towards low risk sectors during the year supported growth in balance sheet amidst a difficult economic environment

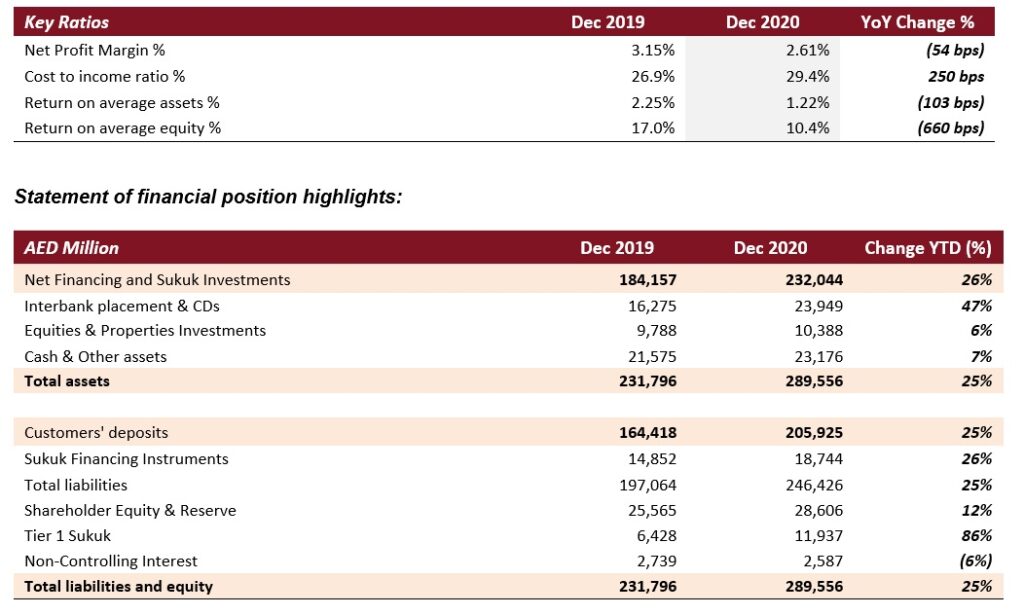

- Total assets grew by 25% to AED 289.6 billion vs AED 231.8 billion in 2019 despite headwinds clearly showcasing the ability of the bank to unearth business opportunities using its well-entrenched franchise.

- Net financing and Sukuk investments rose to AED 232.0 billion vs AED 184.2 billion in 2019, up by 26% YoY as the bank focused on sectors with minimal risk and capital consumption – a deliberate and strategic shift to counter challenges posed by the pandemic environment.

- Customer deposits increased to AED 205.9 billion up by 25% YoY, a testament to bank’s ability to generate and manage liquidity in the testing scenario during the year.

- CASA component increased to 42% from 33% when compared to YE2019, supported by the Noor acquisition as well as the strategic focus on salary and transactional accounts.

- Cost to income ratio at 29.4% from 26.9% in 2019 marginally rising primarily due to the manpower integration cost incurred during the early part of the year – expected to improve as cost synergies start to materialize further in 2021.

- ROE at 10.4% still remains at the higher end of the market, despite the conditions underlining the focus of the bank on shareholder returns.

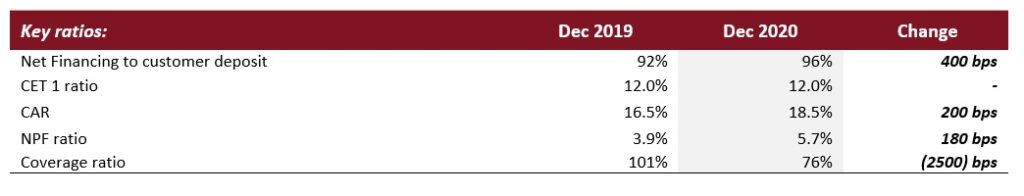

- Financing to deposit ratio stood at 96% clearly underpinning DIB’s consistently strong liquidity and the ability to generate the same irrespective of market challenges.

- Overall coverage, including collateral at discounted value, stands at 104% despite the general market rise in NPFs during 2020 due to adverse conditions.

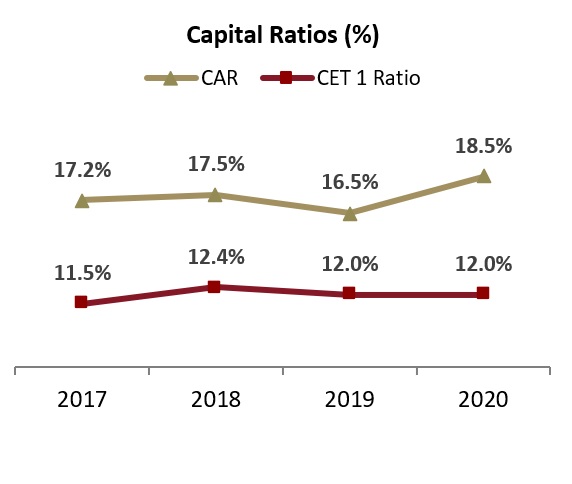

- Capital adequacy (CAR) ratio improved to 18.5%, a rise of 200 bps despite significant growth in financing assets. CET 1 also remain stable at 12.0% well above the minimum regulatory requirements.

Management’s comments for the full year ending December 2020

His Excellency Mohammed Ibrahim Al Shaibani

Director-General of His Highness The Ruler’s Court of Dubai and Chairman of Dubai Islamic Bank

-The UAE continues to lead the world in responding quickly to this pandemic and ensuring that its people are provided with the necessary healthcare and safety services to overcome this unprecedented event. We are grateful for the strong leadership of this nation in championing the fight against the pandemic as we successfully navigate ourselves through this crisis.

-In line with the government efforts to support the domestic economy during the pandemic, DIB has provided relief measures of nearly AED 9 billion to over 54,000 customers in retail and corporate under the UAE CB’s TESS Program. These measures were extended to benefit our client base and to ensure business continuity

-The successful early completion of our integration with Noor Bank amidst unfamiliar working conditions is a testament to the capabilities of executing our strategic aspirations irrespective of testing economic conditions. The efficient coordination amongst all key stakeholders resulted into one of the fastest integration in the region.

-The DIB franchise is capable of weathering challenging situations and possesses the ability to come out as a winner, as it has done in similar situations in the past. The confidence shown by investors, stakeholders and customers alike towards the DIB Group is testament to the trust and dependability that it owns.

Abdulla Ali Obaid Al Hamli

Board Member and Managing Director

The continued support and guidance of the regulatory authorities has been crucial throughout this challenging year and the financial sector has been able to significantly minimize the impact of the crisis and continue to grow and remain profitable amidst a difficult operating environment.

-The repositioning of our institutional purpose and values to adapt to the changing landscape will ensure that our customers continue to receive unsurpassed service and experience across all our channels and branch network and will pave the way for sustained growth for DIB in the years to come.

Dr. Adnan Chilwan

Dubai Islamic Bank Group Chief Executive Officer

-DIB has remained steadfast and continuously provided a counterbalance against the impact that the pandemic presented. The organization ensured customer impact remained minimal all though the year and also provided them with the opportunity to benefit from convenient and easy to access digital solutions to manage their financial relationship with the bank.

-DIB’s strategic priority is aligned to that of the UAE, to focus on and plan for the future, and this is demonstrated in the prudent risk management approach and provisions taken to create cushions and to ensure the bank remains protected from any such situation that may occur in the near future.

-The bank’s total income of more than AED 13 billion and net operating revenue of AED 9.5 billion has been remarkable considering subdued global and domestic economic activities. The growth in pre-provision profits despite the muted landscape and declining interest rates signifies the strength of the bank’s franchise and its ability to grow in a tough macro environment. The focused strategic growth in 2020 will yield rich dividends generating additional income in subsequent periods as the environment improves.

-Our deliberate shift in strategy at the height of the pandemic and strong relationships enabled us to tap into lower-risk sectors, primarily on government related lending. This allowed us to grow our balance sheet to AED 289 billion (growing 25% year-on-year). This also ensured quality returns in the succeeding quarters with minimal use of our capital whilst maintaining strong margins and healthy liquidity.

-Today for DIB, as it is for the UAE and the world over, is a new day and the past is behind us. We have aligned our future vision to that of the UAE by embarking on a new journey, with a renewed purpose and revamped positioning that is called #ReadyForTheNew. The aim is to make financial solutions simple, convenient and accessible to all through engaging experiences. Supported with a new set of corporate values, this will ensure alignment to the new norms in continuing to protect and nurture our business relationships in the years to come.

Financial Review

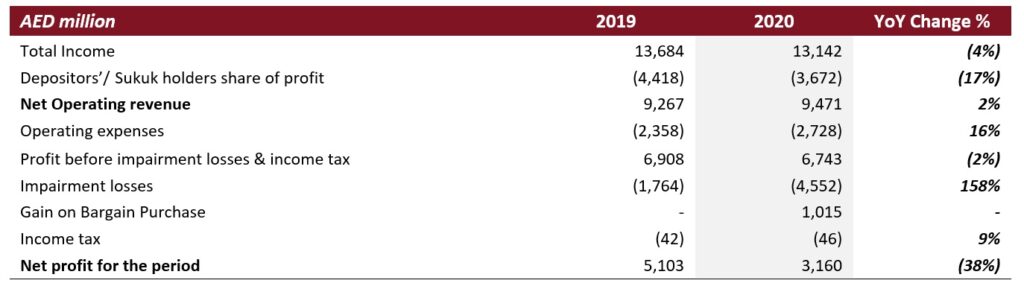

Income Statement highlights:

Operating Performance

The bank’s total income reached AED 13,142 million for the year 2020 compared to AED 13,684 million in 2019, a marginal decline of 4%. The decline in total income can be attributed to the pandemic impact on the domestic economic activity. Income from Islamic financing was at AED 10,370 million whilst non-funded income which included commissions and fees was at AED 2,772 million for the year.

Net operating revenue increased by 2% to AED 9,471 million supported by lower cost of fund during the year. Commission and fees continue to support income by growing 11% reaching AED 1,646 million in 2020.

Operating expenses reached AED 2,728 million for the year ended 2020 against AED 2,358 million in 2019, an increase of 16% year on year. Integration expenses and consolidation of Noor Bank earlier in 2020 is primarily attributed to the rise of operating expenses. Cost to income ratio is now at 29.4% for the year ended 2020, an increase of 250 bps compared to 26.9% in 2019. This is expected to steadily improve as synergies materialize.

The net profits of the bank for the year ended 2020 reached to AED 3,160 million a decline of 38% year on year stemming from subdued global and domestic economic activity due to the pandemic and taking a more prudent approach to provisioning. The growth of the balance sheet through the strategic shift towards lower risk sectors is expected to provide a more sustainable income and revenue stream for the bank in the succeeding quarters.

Balance Sheet Trends

The net financing & Sukuk investments grew to AED 232.0 billion for the year ended 2020 from AED 184.2 billion at the end of 2019, a robust rise of 26%. Realignment of strategy focusing on lower risk sectors, particularly sovereigns, and gross new consumer financing of nearly AED 13 billion continue to be key drivers of the bank’s growth during 2020.

Customer deposits grew to AED 205.9 billion in 2020 from AED 164.4 billion at year-end 2019 reflecting strong rise of 25%. CASA rose strongly by 58% to AED 86.2 billion, growing from AED 54.6 billion in year-end 2019. This currently represents about 42% of customer deposits. Net financing to deposit ratio stood at 96%, signifying ample liquidity despite material growth in financing book. Liquidity coverage ratio (LCR) is at 129% which is currently well above the minimum requirement set by the UAE Central Bank of 70% as part of the TESS program.

Non-performing financing (NPF) ratio stood at 5.7%. Cash coverage and overall coverage ratio, including collateral at discounted value stood at 76% and 104% respectively. Normalized cost of risk for the period was 137 bps (excluding one-off charges).

Capital adequacy improved to 18.5% (+200 bps) and CET 1 ratio stable at 12% during the year. Despite strong growth during the year, capital levels remain intact and well above the minimum regulatory requirement.

Q4 2020 – Key business highlights:

-DIB successfully completed the integration of Noor Bank in end of October 2020 with the full migration of all banking relationships to DIB. The integration was achieved well ahead of projected deadline which was targeted by end of 2020. The entire integration was achieved in record time despite unfavorable circumstances, as majority of the teams involved worked remotely due to COVID-19 restrictions. The acquisition further enhances DIB’s position as one of the largest Islamic banks in the world and a key driver towards the growth of Islamic finance globally.

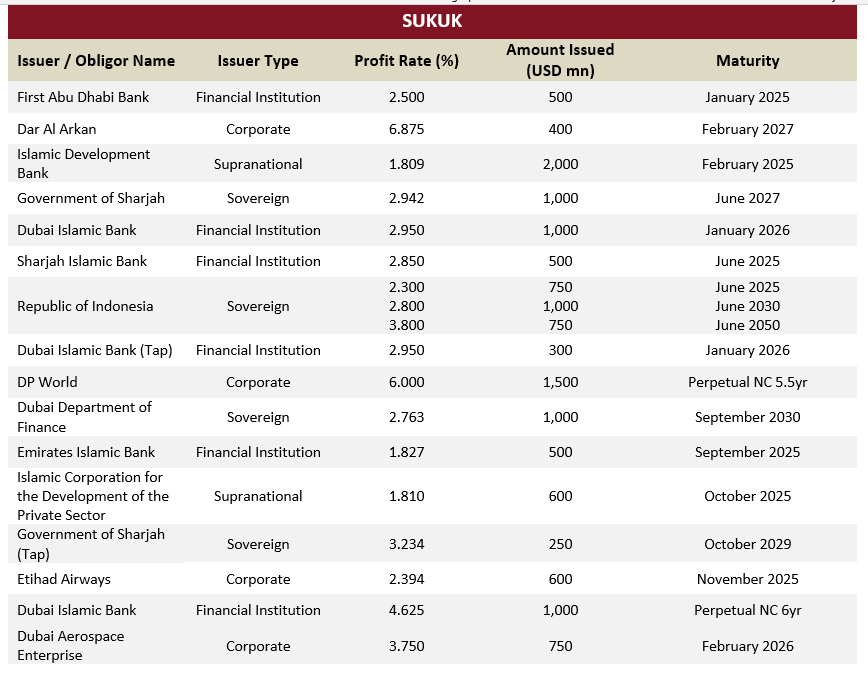

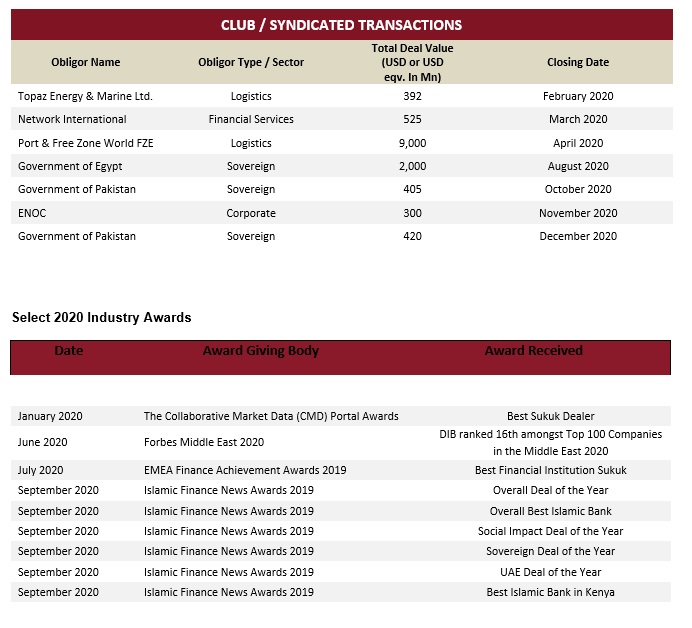

-Despite a very challenging 2020, DIB continued to be at the forefront of the Islamic financing and capital markets space having completed transactions valued of over USD 27bn. DIB continued to execute high profile deals for a range of clients including sovereigns, supranationals, quasi-sovereigns, large corporates to financial institutions. DIB continues its leading position in the Bloomberg league tables in EMEA Islamic financing MLA (Mandated Lead Arranger) as well as BR (Bookrunners) and is also amongst the top of the Bloomberg Islamic finance and Sukuk league tables in the world today.

-In November 2020, DIB successfully prices a USD 1 billion Perpetual Non-Call 5.5 yrs Additional Tier 1 Sukuk with a profit rate of 4.625%. This transaction carries the lowest ever yield achieved by any bank globally on an AT1 Sukuk issue and is the only AT1 Sukuk from the GCC in 2020. Despite the turmoil witnessed in markets this year during the peak of the COVID-19 crisis, DIB’s success in this landmark transaction is a testament to the bank’s strong credit profile and standing with international and regional investors. It reaffirms the confidence of international investors not only in DIB but in Dubai and the UAE.

The bank continued to support to customers impacted by the Covid-19 pandemic during 2020 by providing relief measures of nearly AED 9 billion to over 54,000 customers towards retail and corporate customers of DIB. In addition, the bank continues to support the well-being of its employees by ensuring that the standard working procedures as advised by the health authorities are being adhered to and encouraging to support the government initiative on vaccination for UAE residents both in the public and private sectors.

FY 2020 DCM and Syndication Deals